The Election’s Impact on the Real Estate Market: Colorado Springs Update

As we wrap up the year, many are curious about the state of the housing market and its trajectory heading into 2025. A recent poll revealed that 88% of Americans feel now isn’t a good time to buy a house. Days on market have risen, showings are down, and sales seem unpredictable. So, is the housing market crashing, or is this just a transitional phase? Let’s dive into the Colorado Springs real estate market to unpack the latest trends and understand the role of elections in shaping housing dynamics.

Market Overview: Trends and Data

The Colorado Springs housing market, like many others, is experiencing mixed signals. Here’s a breakdown of the most recent data:

- New Listings and Sales

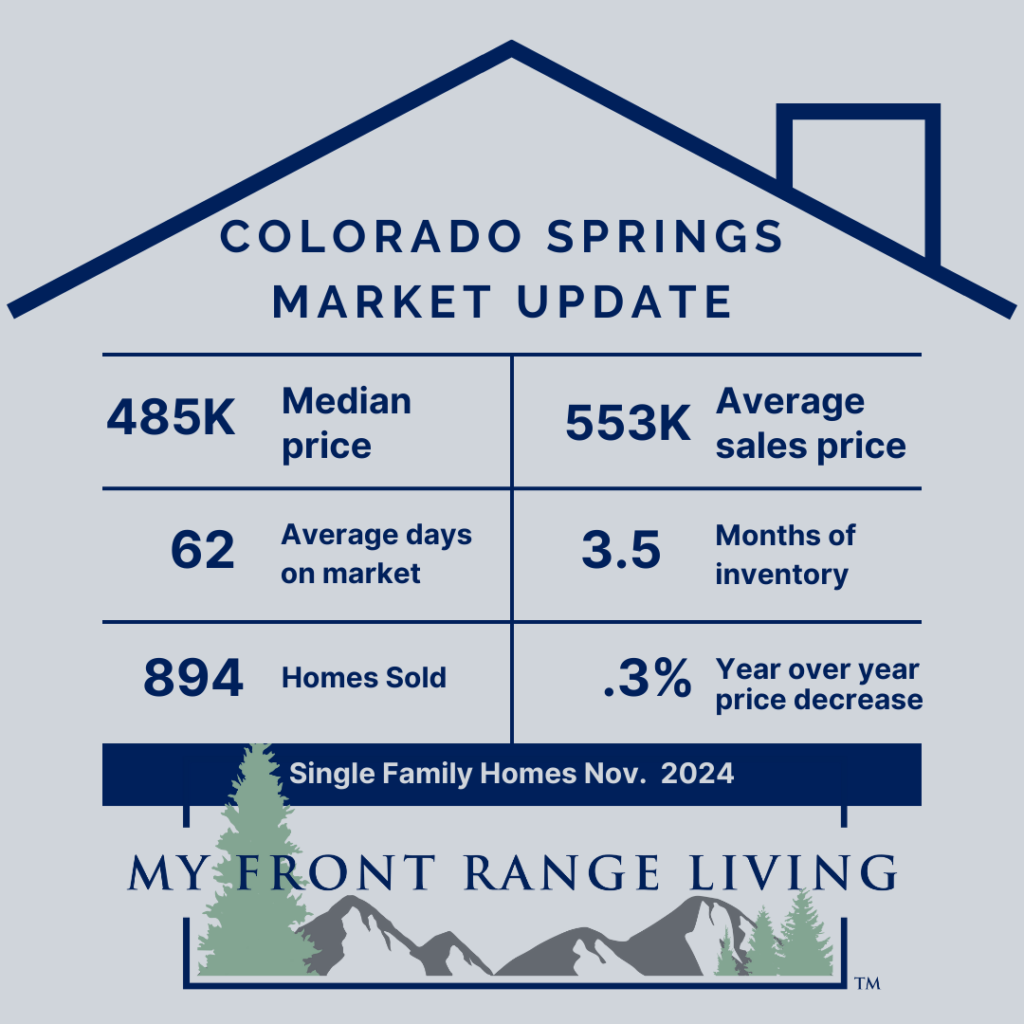

- New homes listed: 893 in November, nearly identical to November 2023 (895).

- Total home sales: Down from 998 in October to 894 in November. However, sales are up compared to the same time last year (715 in November 2023).

Takeaway: While sales have dipped month-over-month, they’re showing significant improvement compared to last year.

- Average and Median Sales Prices

- Average sales price: Slight decrease, from $557K in October to $553K in November—just a $1K drop year-over-year.

- Median sales price: Increased from $475K in October to $485K in November, up from $466K in November 2023.

Takeaway: Despite fluctuating consumer sentiment, home prices are holding steady, with some increases in key metrics.

- Inventory and Days on Market

- Available inventory: 3,092 listings in November, up from 2,397 in November 2023.

- Days on market: Average of 62 days, nearly doubling over the past three months.

Takeaway: Buyers have more options compared to last year, but homes are sitting on the market longer due to low consumer confidence.

Consumer Sentiment: The True Market Driver

Current market hesitation isn’t rooted solely in interest rates. While rising rates have made homeownership more expensive, other factors are equally influential:

- Insurance Costs: Higher insurance premiums are straining budgets.

- Property Taxes: Stable or increasing home values mean tax bills remain high.

- Inflation: Monthly living expenses are stretching household finances to their limits.

These combined pressures have led many potential buyers to adopt a “wait and see” approach, contributing to longer days on market and lower showing activity.

Election Results and Housing Market Implications

The recent election has sparked conversations about how new leadership might influence real estate. However, any impact will likely be indirect and delayed. Here’s why:

- Administrative Focus: The incoming administration will prioritize tackling inflation and managing overall living costs rather than directly addressing interest rates.

- Interest Rates: Historically, the Federal Reserve—not the administration—drives rate changes. While interest rates will remain a focal point for consumers, significant shifts are unlikely to result directly from election outcomes.

Ultimately, the administration’s policies on inflation and affordability may indirectly influence the housing market, but these effects will take time to materialize.

What Does This Mean for Buyers and Sellers?

For Buyers:

If you’ve been hesitant to enter the market, consider that home prices remain stable, and inventory has improved compared to last year. While higher interest rates add to monthly costs, waiting may mean missing out on favorable pricing.

For Sellers:

Pricing your home competitively is key. With increased inventory and rising days on market, appealing to today’s cautious buyers requires strategic pricing and presentation.

Looking Ahead to 2025

The real estate market remains in flux, influenced by inflation, affordability, and consumer sentiment. While elections might steer broader economic trends, their direct impact on housing is minimal in the short term. As we approach 2025, keeping a close eye on interest rates, inventory levels, and local market conditions will be crucial for anyone navigating real estate decisions.

Have questions about the market? Feel free to reach out—our team is here to help!

About The Author

The team at My Front Range Living are a group of full time real estate experts serving Colorado Springs, El Paso County and the surrounding areas. Their knowledge of the local community and experience in the industry provide you incomparable value when buying or selling a home. With several years of experience in helping out of state buyers and sellers, they are the go-to team when it comes to relocating and helping Colorado feel like home.

The team at My Front Range Living are a group of full time real estate experts serving Colorado Springs, El Paso County and the surrounding areas. Their knowledge of the local community and experience in the industry provide you incomparable value when buying or selling a home. With several years of experience in helping out of state buyers and sellers, they are the go-to team when it comes to relocating and helping Colorado feel like home.

Even if you’re looking for an agent in another city or state, the My Front Range Living team has a network of experts that can connect you with the right professional.

Colorado Springs Relocation Guide

🏡 Moving to Colorado Springs? Download our FREE Colorado Springs Relocation Guide!